Active Market Space - Bank Tools to Solve Global Markets Workflow Challenges

In Spring 2019, our CEO John Ashworth wrote an article that was published in Profit and Loss Magazine on the Past and Future of Single Dealer Platforms and Portals. We looked at the technology drivers and what we saw as the current trends in that space. Based on our conversations with clients, this update looks at whether there have been significant changes since then.

Today, 2019 seems like it belongs in a different era: Covid 19 had not yet surfaced, any talk of a major war in Ukraine was the stuff of speculation, interest rates and FX market volatility were near an all time low, and with natural gas prices a quarter of today’s levels, energy security was not a main topic of conversation. Even Bitcoin was languishing under $4,000!

Given the life changing magnitude of many of these events, it might seem trivial to focus once again on the state of e-commerce in markets, but technology advancement is opportunistic and waits for no one.

Data Rich

The BIS published its Triennial Central Bank Survey of foreign exchange and OTC derivatives markets in December 2022, based on data collected in April 2022. This is a comprehensive document, with many of the observations stemming from the immediate aftermath of Russia’s invasion of Ukraine, with all the rise in volatility and risk premia that that entailed. This widespread uncertainty is one of the reasons why the BIS highlighted a sharp increase in the use of short term derivatives in April 2022 as market participants were less confident about taking on term risk.

Given that the previous survey was conducted in April 2019 and released at the end of that year it serves as a useful comparison

with today’s figures.

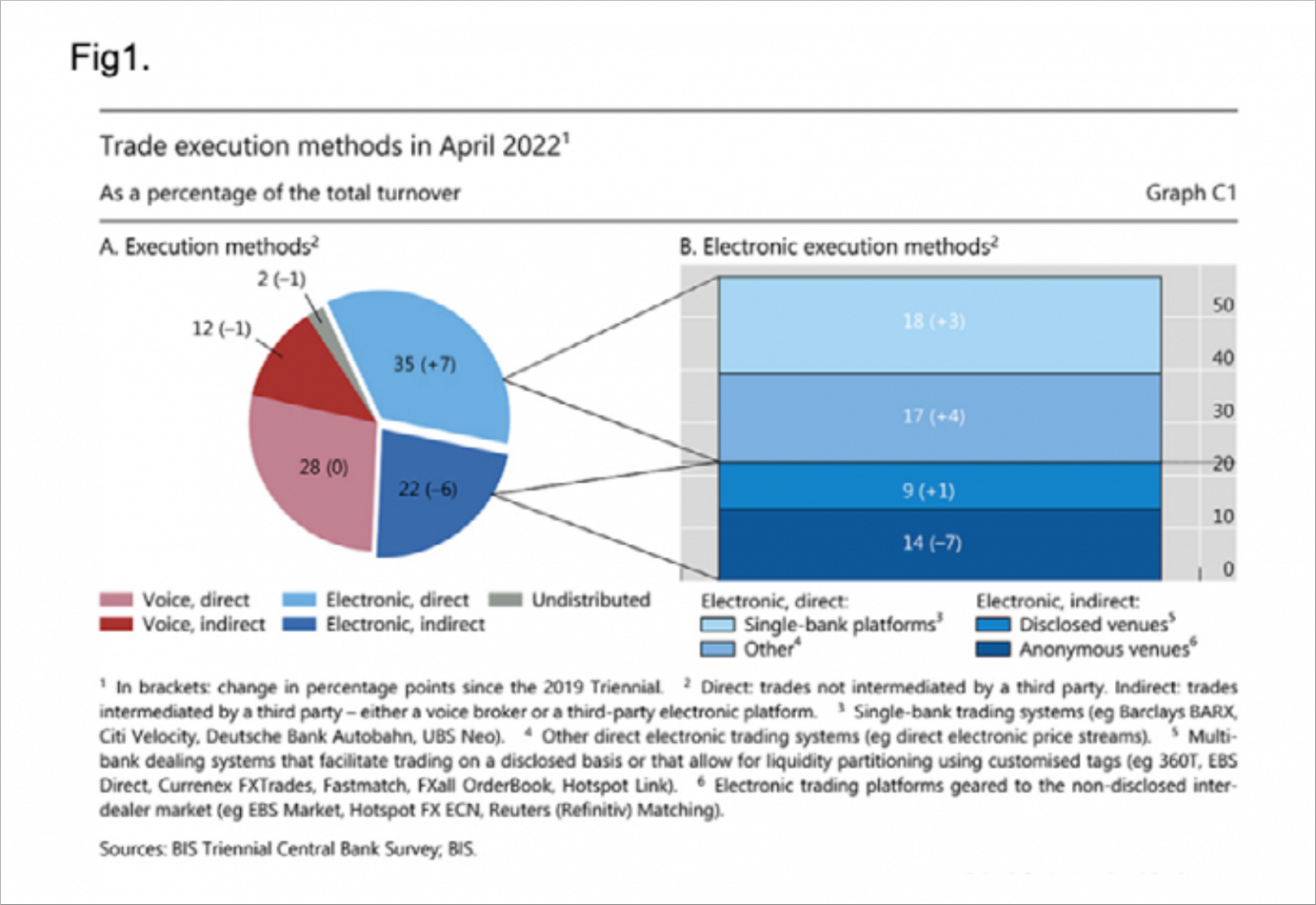

If we simply focus on FX trade and execution methodology in 2022, it is unsurprising that the percentage of trading done over electronic methods versus over the phone stayed constant at 57% vs 43% compared with 2019.

However, what is fascinating is that the data, on ‘e’, reveal a market shift towards ‘direct’ execution with a single bank, on a Single Dealer Platform via GUI or API away from ‘indirect’ execution, for example, over a Multi Dealer Platform or an anonymous venue.

In 2019 of that 57% of electronic flow, 28% was deemed ‘direct’ and 29% ‘ indirect’.

In 2022 of that same 57%, 35% was ‘direct’, and 22 % ‘indirect’. (Fig.1)

Performance measurement

One of the conclusions that can be drawn from this is that price sensitive clients are relying less on MDPs, which charge banks brokerage, to obtain a price in competition because there are alternative, more sophisticated ways of measuring best execution. Multiple firms offer independent transaction cost analysis, looking at market impact resulting from information leakage whether from a single trade or from an algo, and best execution is not only about the best one-off price on a single deal, easy though that is to document.

These statistics imply that a direct e-channel with partner banks is increasingly of value. A Global Markets relationship is not just execution, which is why far-sighted banks are looking to expand their offering into a more active workspace offering solutions to clients’ challenges.

Is the trend your friend?

If we now review the earlier article, what do the trends identified in 2019 look like in 2022?

We highlighted the need to serve internal as well as external clients, consolidating flow in whatever asset class in the part of the bank best equipped to handle it.

We saw that Sales and clients both needed specific yet different tools to enable them to do their jobs more effectively alongside a client and data management structure equipped to turn data into information and then into actionable insights. We felt that many banks underestimated the need to take business mobile apps seriously and faced an existential threat from challenger banks and disruptive fintechs. We were convinced that client segmentation and behaviour analysis lay at the core of any successful application deployment. It’s clear today that many of those observations are still valid and have been augmented by new ones.

Engagement needs information

Sales productivity is still a key priority for many banks, and there are several ways to achieve this. Whilst some banks have started the move toward full client self-serve, with the Sales role migrating to structural advisory rather than execution, many others are only now upgrading the tools used by Sales to enable them to have a better picture of overall client activity and increase productivity. Being able to pull information from different systems into ‘widgets’ in the sales application is increasingly important , either directly or by using commercially available workspace management tools.

Increasing the reach and skill set of Salespeople is also essential to ensure they add value to the client relationship. Encouraging them to branch out into other products or asset classes future proofs the Sales role. Demystifying more complex products like structured products or options hedging strategies improves transparency and boosts client takeup. So simplifying tickets to strip out unnecessary fields and present results with easy-to-read graphics and plain language enables Sales to become more proficient in selling higher value products and clients gain confidence in using them.

Buy what you can, build what you have to

Navigating the Byzantine world of bank departmental silos and internal politics is as challenging as ever. Yet the logic of sharing a common technology platform and preventing unnecessary duplication of effort and expense is inescapable.

Banks’ senior management and technology teams are asking themselves which core technology components can be shared, and which applications, with minor changes, are common to multiple areas of the bank. This has helped the ‘buy vs build’ argument to mature ; it’s no longer a binary choice. Establishing a trusting, working partnership with a technology firm is seen by many as creating the best of both worlds. Banks can buy the components that need not be built nor maintained in-house. These can be as complex as a high-performance, service-orientated, real-time web trading framework, or as simple as a button on a GUI. This would allow them to focus their efforts on understanding their internal and external clients’ needs, making that their competitive advantage. This also avoids many of the pitfalls of the ‘black box’ approach in terms of delivery, specification and ultimate dependency.

Post-trade workflows, from the immediate rolling of spot trades and allocation of trading accounts right through to the confirmation and attachment of Settlement Instructions, are getting much more attention. Simplifying and automating manual data entry tasks reduces error and increases productivity and transparency. Banks are looking to bake in such automation at every stage of the deal lifecycle, rendering some of those old manual tasks unnecessary, and the unavoidable ones less onerous. Where components exist that already do this, it makes sense to buy these rather than try and reinvent the wheel.

The host with the most

Banks are becoming increasingly comfortable with the notion of hosting services in the Cloud. They may choose to manage them themselves, or contract with a technology provider to do that, not least to benefit from high availability, take advantage of advances in hardware technology and reduce the need for costly and inefficient Disaster Recovery sites.

For smaller banks looking for a ‘bank in a box’ e-FX solution, having an externally hosted service with suitable SLAs reduces the burden on internal technology staff, is cost effective and makes for a much smoother upgrade process.

Movers and shakers

Finally, the Covid pandemic accelerated the need to make remote working a viable, secure and productive option. There has been a significant increase in the number of banks looking at mobile solutions not simply as a toy version of the desktop, although mobile companion apps are often the first stepping stone. Banks realise that their customers, especially in the SME business banking corporate sector perform more and more operations on the move. Advances in authentication and encryption, audit trails, user controls and a general familiarity with the flexibility of a mobile offering, as demonstrated by many of the challenger banks, has pushed Mobile into the limelight. Mobile is not being seen simply as a riskier version of the desktop, but as a workflow tool to inform, empower and enable clients to access a bank’s markets’ offering more comprehensively. This creates stickiness, brand awareness and boosts productivity all around.

What’s in a name?

Perhaps there is a parallel in the early days of motorised transport back in the late 19th century. As automotive engineers and inventors struggled to remove the horse from the equation, the term ‘Horseless Carriage’ became popular. It was an attempt to describe the new technology by defining what it wasn’t.

Once the term ‘Motorcar’, or ‘Automobile’ took hold, and people weren’t focusing on the ‘horselessness’ of the vehicle, its potential started to be realised and innovation took hold.

So in 2023, is Single Dealer Platform or Portal still an appropriate term?

Twenty five years ago, the earliest SDPs simply allowed professional clients to ‘deal’ with a ‘single’ bank over a branded ‘platform’. ‘Single’ implied restriction of choice, ‘Dealer’ only focused on one aspect of the trade lifecycle (and not the most important for many client types) and ‘Platform’ had the ring of ‘standalone’ about it.

The vision that banks would offer, instead, each client an active markets workspace that was integrated into that clients daily workflow was some way off. That vision, of multiple tailored access points into a relationship bank’s global markets technology infrastructure, is only now starting to emerge. Open banking legislation, the extensive use of APIs, the acceptance that clients have a choice and are increasingly used to ‘wanting it their way’ alongside the rapid rise of challenger banks and alternative payment providers mean that traditional banks are going to have to move quickly and effectively to retain client loyalty.