Post-trade productivity boost

Mid-pandemic, the outlook for the global economy was pretty bearish, including the prospects for the banking sector. In May 2020, Management consultants McKinsey in their report Time to radically rethink bank productivity, predicted a downturn that would last until mid 2023. They highlighted productivity gains as the solution and listed seven steps banks could take to survive the downturn and emerge stronger.

With hindsight, McKinsey misjudged the speed of the recovery, but were spot on with the need for productivity gains.

Busy or productive?

For many years, banks have looked at ways to measure Sales productivity and to improve it, just as they measure Trader performance and adjust it for risk and intrinsic seat value. A common complaint - and it’s one upheld by many enlightened salespeople and managers - is that Sales spend too long on post-trade administrative tasks that keep them extremely busy, but not terribly productive. In an ideal world, post-trade tasks shouldn’t exist at all; at the point of execution, almost all the variables could be, and should be known, like currency pair, size, value date, direction, booking account and settlement details. Yet we don’t live in an ideal world, and often there is the need to add or adjust elements of the trade once the execution has happened. The secret is in making these adjustments as automated and as painless as possible.

Unexpected item in bagging area

Self-checkouts have been around since the 1990’s and attract both fans and opponents in equal measure. Certainly, when faced with long queues at a manned register, a well designed, error free self-checkout can be a joy, improving efficiency, saving time and improving customer satisfaction. Get it wrong, however, and the final impression a customer gets as they try to complete a transaction is far from positive.

The same principle holds true for FX transactions: execution is just one part of the process. A cumbersome post-trade engagement or, worse, a failed settlement can ruin a client relationship. Automating it and getting it right is harder than it looks but, once achieved, will deliver a more productive sales team and happier, empowered clients. How does a bank prioritise which tasks to encourage a client to self-serve on versus which ones to retain a degree of sales involvement?

From the client perspective, post-trade administrative tasks fit into three categories:

- Tasks that clients should perform themselves, where unnecessary involvement of sales runs the risk of error or even fraud.

- Tasks that clients could perform themselves, or else might like the guidance of a trusted Sales advisor

- Tasks that are decidedly complex or where delay might result in unnecessary risk exposure to the bank and/or client.

From the bank’s perspective, there is a 4th category - increased revenue generation. Would the involvement of a sales representative create an opportunity to serve a client better, through identifying a risk, or providing an opportunity to consolidate and reduce exposure and so generate additional revenue as well as enhancing customer satisfaction and strengthening the relationship?

Resolving workflow bottlenecks

The term ‘post trade’ covers a multitude of sins, but broadly speaking, there are 3 types:

- Trade lifetime events

- Trade replacement workflows

- Immediate post-execution workflows

Trade lifetime events

Trade lifetime events comprise:

- Affirmations

- Confirmations

- SI attachment/management

- Settlement netting

- Settlement splitting

- Options exercise events

Many banks still involve Sales or Middle Office in these tasks, and the only reason why clients cannot self-serve on these is if the bank has not provided them with the right tools. Increasingly, across industry in general, surveys show that customers expect an organisation to have an online self-service support portal, and banks are no exception.

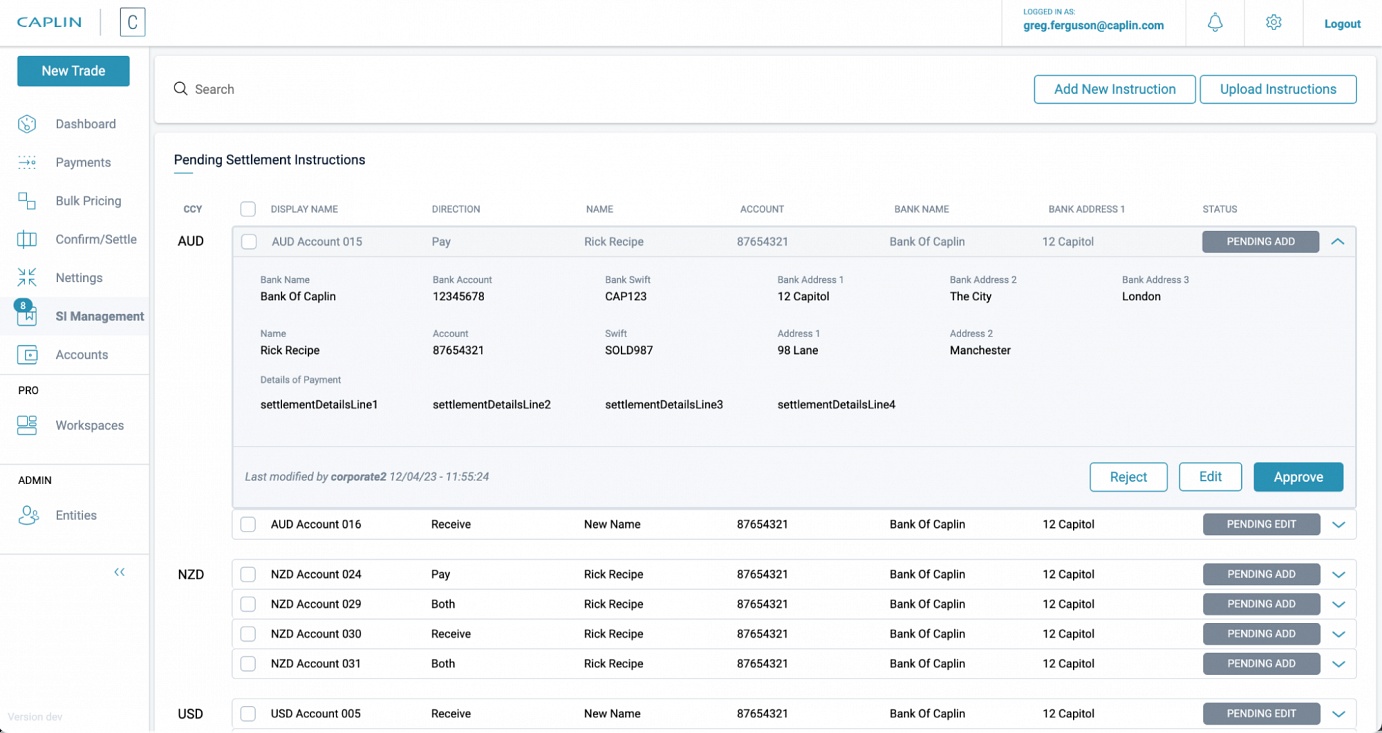

Once the bank’s Core Banking System is capable of saving multiple settlement instructions (SIs) and assigning them to different accounts, then providing clients with a well designed, intuitive interface is an effective way of ensuring clients take full responsibility for the whole process. This would eliminate re-keying errors, speed up the affirmation/confirmation cycle and provide a secure, audited trail that protects the client and the bank.

Caplin’s Post Trade solution has reduced the time taken to perform these post-trade tasks from hours to minutes, encouraged clients to strengthen their own internal compliance by reinforcing the ‘4 eyes’ principle, and by using the new Mobile Post Trade companion app with push notifications, accommodate ‘on the move’ actions for urgent situations or when remote working. Lastly, the ancillary benefit has been that the bank’s clients now view the bank as having a truly digital experience, which is helping their competitive edge.

Trade replacement workflows

Examples of trade replacement workflows include extending existing forward positions through the use of FX swaps, or closing them out by creating equal and offsetting trades. Clients may wish to consolidate multiple existing positions into one new one, potentially improving transparency and reducing credit exposure.

For such operations, clients can certainly self-serve if their bank’s FX solution enables them to view upcoming maturities easily, sorting and filtering swiftly according to their needs, and with a few mouse clicks price and execute the required replacement. Intelligent use of User Defined Fields enables the new trade(s) to be linked to the old, adding to the audit trail.

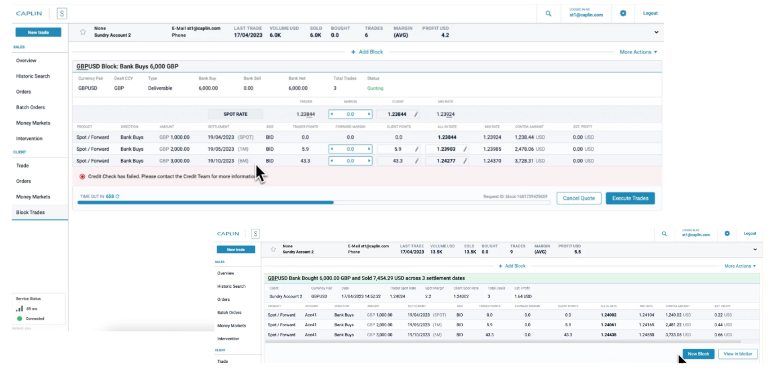

In certain circumstances, Sales involvement in such operations may be very helpful. Reminding clients of upcoming expiries can sometimes generate trade opportunities, creating a reason to engage with the client, assessing their current situation and suggesting appropriate strategies where permitted. For this to be successful, Sales need to have access to a comprehensive blotter of relevant client activity, and awareness of trading and credit limits as well as regulatory status. Whereas in the past, salespeople have had to look at multiple systems to form an overall picture of the client situation, increasingly, the use of Sales Dashboards are providing salespeople with all that information in one place. Working with a technology partner that has extensive integration experience like Caplin can shorten the time to market by allowing internal IT departments and the external technology partner to each focus on their respective core strengths.

Immediate post-execution workflows

These are activities where a speedy response is essential, for example cancelling a trade executed in error (it happens), or amending an amount. Enabling Sales and/or the client to find the offending trade quickly shortens the time when undesired risk is carried for client and bank, and being able to remedy the situation via an intuitive user interface with a comprehensive audit trail, gives comfort, increases client confidence in the bank and reduces risk. There are certain other post-trade activities that can be carried out independently by the client or with the assistance of sales in order to manage credit lines more effectively, e.g. allocating a trade to different trading accounts and, where necessary, rolling such trades to a variety of forward dates.

Final thought — upskilling to retain talent

In the McKinsey article on bank productivity referenced at the start of this article, upskilling the workforce and equipping it to ‘lead not lag’ digital innovation is essential. Encouraging employees to adopt new skills so that they can engage with the client base of the future is beneficial to employees and employers alike. The World Economic Forum estimates that 1.1 billion jobs will probably be radically transformed by technology in the next decade, and financial services is no exception.

Several banks we are speaking to are looking to free up Sales from administrative tasks and refocus efforts on more profitable areas including options structures and alternative asset classes. It is important that, from the outset, these new areas of revenue growth are integrated into the digital offering. Ultimately, this will achieve the goal of serving increased demand at lower cost.

Most banks that cover corporate clients, especially in the SME sector, are threatened by the new wave of digital challenger banks. On the one hand, these new entrants do not have the legacy infrastructure that can deter some existing banks from embracing the digital age. On the other hand, the newcomers rarely have the strong existing client relationships that count for so much especially in uncertain economic times. This relationship advantage will not last forever, and the banks that embrace such changes to their existing business model are the ones most likely to succeed.